The following scenario relates to questions 1–5You are an audit senior of Viola & Co a

The following scenario relates to questions 1–5

You are an audit senior of Viola & Co and are currently conducting the audit of Poppy Co for the year ended 30 June 20X6.

Materiality has been set at $50,000, and you are carrying out the detailed substantive testing on the year-end payables balance. The audit manager has emphasised that understatement of the trade payables balance is a significant audit risk.

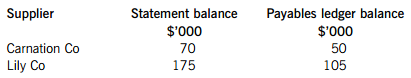

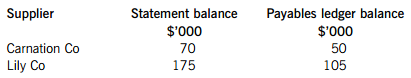

Below is an extract from the list of supplier statements as at 30 June 20X6 held by the company and corresponding payables ledger balances at the same date along with some commentary on the noted differences:

Carnation Co

The difference in the balance is due to an invoice which is under dispute due to faulty goods which were returned on 29 June 20X6.

Lily Co

The difference in the balance is due to the supplier statement showing an invoice dated 28 June 20X6 for $70,000 which was not recorded in the financial statements until after the year end. The payables clerk has advised the audit team that the invoice was not received until 2 July 20X6.

The audit manager has asked you to review the full list of trade payables and select balances on which supplier statement reconciliations will be performed.

Which of the following items should you select for testing?

(1) Suppliers with material balances at the year end

(2) Suppliers which have a high volume of business with Poppy Co

(3) Major suppliers with nil balances at the year end

(4) Major suppliers where the statement agrees to the ledger

A.1 only

B.1, 2 and 3 only

C.2 and 4 only

D.1, 2, 3 and 4

Which of the following audit procedures should be performed in relation to the balance with Lily Co to determine if the payables balance is understated?

A.Inspect the goods received note to determine when the goods were received

B.Inspect the purchase order to confirm it is dated before the year end

C.Review the post year-end cashbook for evidence of payment of the invoice

D.Send a confirmation request to Lily Co to confirm the outstanding balance

Which of the following audit procedures should be carried out to confirm the balance owing to Carnation Co?

(1) Review post year-end credit notes for evidence of acceptance of return

(2) Inspect pre year-end goods returned note in respect of the items sent back to the supplier

(3) Inspect post year-end cash book for evidence that the amount has been settled

A.1, 2 and 3

B.1 and 3 only

C.1 and 2 only

D.2 and 3 only

The audit manager has asked you to review the results of some statistical sampling testing, which resulted in 20% of the payables balance being tested.

The testing results indicate that there is a $45,000 error in the sample: $20,000 which is due to invoices not being recorded in the correct period as a result of weak controls and additionally there is a one-off error of $25,000 which was made by a temporary clerk.

What would be an appropriate course of action on the basis of these results?

A.The error is immaterial and therefore no further work is required

B.The effect of the control error should be projected across the whole population

C.Poppy Co should be asked to adjust the payables figure by $45,000

D.A different sample should be selected as these results are not reflective of the population

To help improve audit efficiency, Viola & Co is considering introducing the use of computer assisted audit techniques (CAATs) for some audits. You have been asked to consider how CAATs could be used during the audit of Poppy Co.

Which of the following is an example of using test data for trade payables testing?

A.Selecting a sample of supplier balances for testing using monetary unit sampling

B.Recalculating the ageing of trade payables to identify balances which may be in dispute

C.Calculation of trade payables days to use in analytical procedures

D.Inputting dummy purchase invoices into the client system to see if processed correctly

请帮忙给出每个问题的正确答案和分析,谢谢!

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

答案

答案